Red-hot inflation kindles a flame for commodities and gold

Photos et images © WisdomTree

- Nitesh Shah, Head of Commodities & Macroeconomic Research, WisdomTree Europe

US Consumer Price Index (CPI) rose 6.2% in October 2020, marking the highest level of inflation since 1990. The print, released on Wednesday 10th November 2021, outstripped the Bloomberg consensus survey of 5.9%. The central bank mantra of inflation being transitory is becoming harder and harder to swallow. The fact that the market keeps being surprised by inflation indicates that something is missing from market expectations. We believe that supply-side shocks are both larger and more persistent than the market had expected. Tell-tale signs of supply bottlenecks are littered through the details, including elevated energy and autos prices. Even services are showing broad-based price increases indicating a shortage of labour.

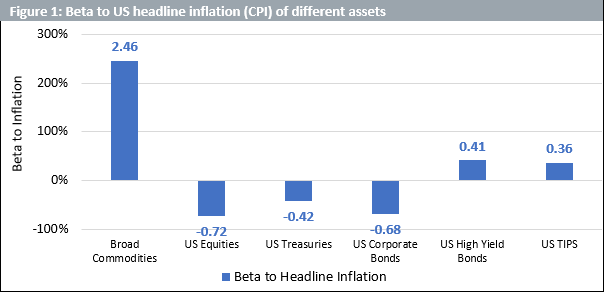

Broad commodities as an inflation hedge

When it comes to assets that can hedge against inflation, commodities stand out as the historical winners. The asset class has the strongest inflation beta of all assets we have analysed. It beats assets that are supposed to be structurally linked to inflation, such as US Treasury inflation-protected securities (TIPS).

Source: WisdomTree, Bloomberg, S&P. From January 1960 to September 2021. Calculations are based on monthly returns in USD. Broad commodities (Bloomberg commodity total return index) and US equities (S&P 500 gross total return index) data started in Jan 1960. US treasuries (Bloomberg US treasury total return unhedged USD index) and US corporate bonds (Bloomberg US corporate total return unhedged USD index) data started in Jan 1973. Historical performance is not an indication of future performance and any investments may go down in value.

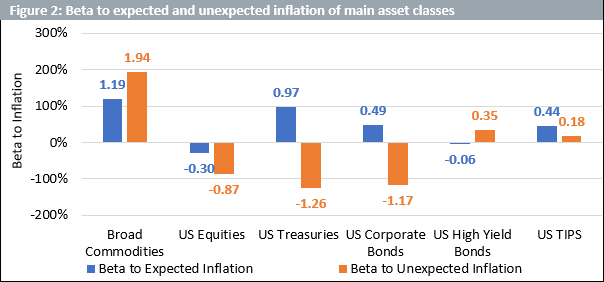

Commodities excel at hedging against unexpected inflation

Commodities are possibly the perfect hedging tool for today’s environment, given the nature of what is driving inflation. Commodities’ beta to unexpected inflation is even stronger than its beta to expected inflation[1]. If the drivers of inflation today are unexpected, then commodities are the place to turn to.

Source: WisdomTree, Bloomberg, S&P. From January 1960 to September 2021. Calculations are based on monthly returns in USD. Broad commodities (Bloomberg commodity total return index) and US equities (S&P 500 gross total return index) data started in Jan 1960. US treasuries (Bloomberg US treasury total return unhedged USD index) and US corporate bonds (Bloomberg US corporate total return unhedged USD index) data started in Jan 1973. Historical performance is not an indication of future performance and any investments may go down in value.

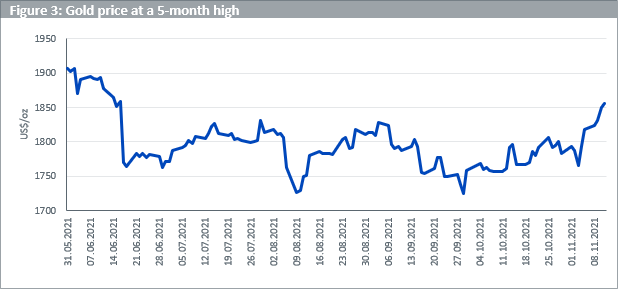

Has gold rediscovered its mojo?

So far this year, gold has disappointed. It has historically been a great hedge for inflation, especially during periods of elevated inflation. Given that we have been in a period of elevated in inflation for the past year, this really should have been the time for the metal to shine. Unfortunately, it has not lived up to its reputation. However, after the US CPI inflation print of 6.2%, gold started to move strongly higher, breaking through US$1860/oz intraday, on the 10th of November, for the first time in 5 months. US Treasury 10-year yields also rose from 1.46% to 1.56% on Wednesday 10th November and the US Dollar basket (DXY) rose from 93.96 to 94.84 on the same day, capping gold’s ascent.

Source: WisdomTree, Bloomberg. From 31 May 2021 to 11 November 2021. Historical performance is not an indication of future performance and any investments may go down in value.

It is yet to be seen whether gold has shaken off its bad mood and returned to its normal behaviour. Our internal forecast models indicate that with this strength of inflation, gold should be trading closer to US$2,300/oz. Acknowledging the potential strength in the US Dollar and rise in Treasury yields likely to result from the Federal Reserve’s tightening path (both in terms of tapering bond purchases and future signalling of rate increases), gold may not make it to US$2,300/oz, but could still rise to US$1900/oz by the end of this calendar year[2]. We have argued that Q4 2021 is a critical time for gold to prove itself. We certainly hope that the 6.2% inflation reading acts as the defibrillator to bring the metal back to life.

All market data is sourced from Bloomberg.

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

[1] We use the short-term T-bill rate as a proxy for the market’s inflation expectations and unexpected inflation is measured as the actual CPI rate minus the nominal interest rate at the beginning of each period.

[2] See Heavy days for the heavy metal for our gold outlook

Retrouvez l’ensemble de nos articles Business ici