China – this time it’s different

Photo © WisdomTree

Par Aneeka Gupta, Director, Macroeconomic Research, WisdomTree

2021 was a volatile year in China. Not only did China grapple with the rise of the Delta variant, power shortages but it also embarked on a self-induced crackdown on the disorderly expansion of capital. The experience of 2021 shows us that Chinese policymakers appeared intent on reducing the economy’s dependence on investment in the real estate sector and gear the economy towards consumption of more domestic goods and services. This clearly did not pan out as planned and by the end of 2021 Chinese policy makers finally threw in the towel and mobilised forces to re-stimulate the economy. The economic restructuring of resources away from real estate towards agriculture, energy and technology will be a more long-term project by China, Inc. than originally planned. It is amply evident that Chinese authorities have a pro-growth agenda in 2022 – the year of the tiger – that have given way to renewed policy easing and are willing to utilise the tools when needed.

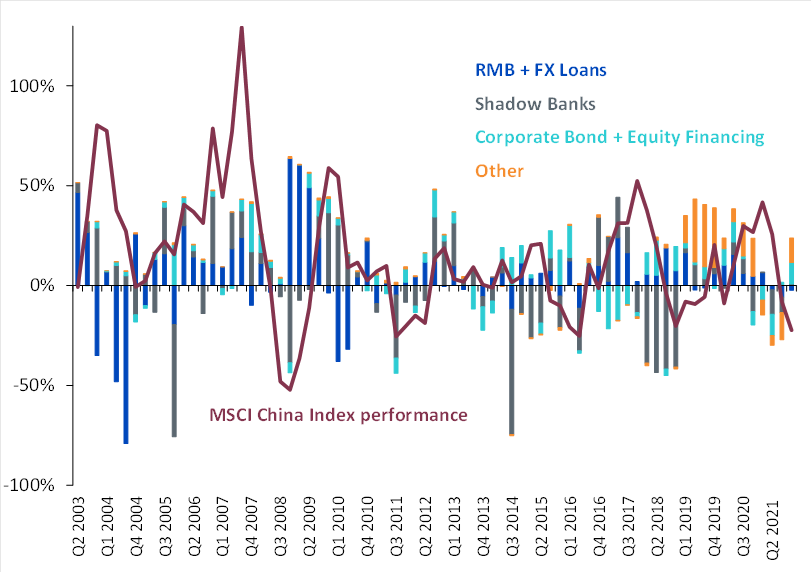

Figure 1 – Quarterly contribution to Total System Financing growth versus performance of MSCI China Index

Source: Bloomberg, WisdomTree as of 31 December 2021. Historical performance is not an indication of future performance and any investments may go down in value.

Low inflation pressure leaves the door open for further monetary easing

Easy financial conditions in China have been an important tailwind for economic growth which should be reflected in 2022. Inflation appears to be less of a concern in China compared to the US. China’s most recent (Consumer Price Inflation) CPI and Producer Price Inflation (PPI) came in lower than expected in December which would allow the People’s Bank of China (PBoC) more flexibility to ramp up its efforts to stimulate the economy and arrest demand weakness. In addition, the PPI-CPI gap should narrow further in 2022 supporting further margin expansion in key industrial sectors of the economy. The PBoC cut the 1year Medium Term Lending (MLF) rate and 7DAY reverse repo rate by 10Bps and injected 290Bn in liquidity on 16 January 2022. According to Reuters News, the Ministry of Housing and Urban-Rural Development are expected to draft new rules related to local monitoring of escrow accounts, allowing easier access to escrow funds in order to help property developers meet their debt obligations, pay suppliers and finance operations. Looking ahead we expect to see further monetary easing via 25Bps of interest rate reduction followed by a 50Bps RRR cut by the H1 2022.

Conviction in China in the year of the tiger

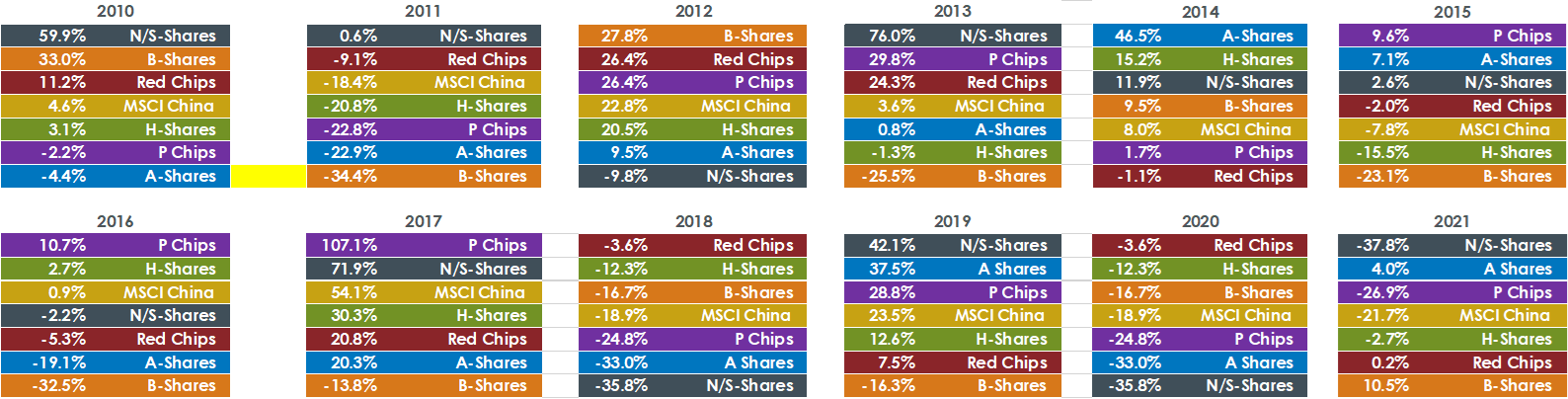

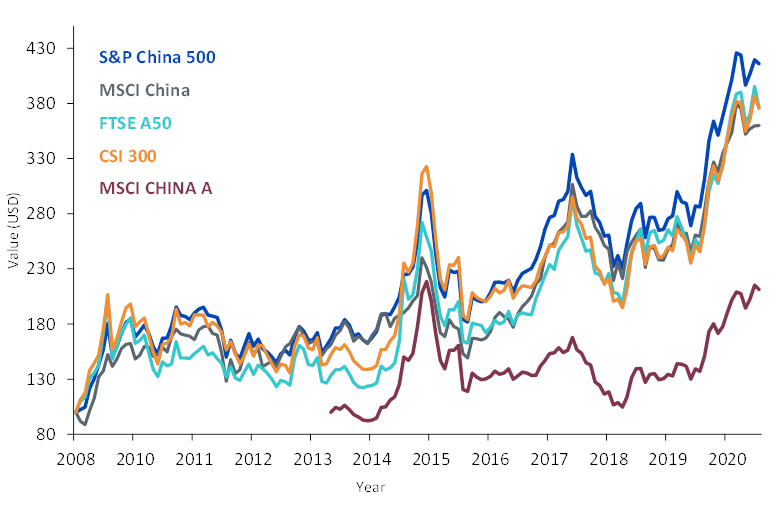

In 2021, MSCI China trailed the MSCI World Index by a staggering 43%. The uncertainty surrounding the regulatory hurdles facing Chinese companies in China, the property crisis alongside COVID-19 related disruptions were among the key reasons accounting for China’s underperformance versus the rest of the world. While it’s difficult to rule of the possibility of further regulatory hurdles, we expect them to ease with the culmination of the Chinese Communist Party’s 20th National Congress, as it has in past political cycles. Interestingly the performance across share classes has varied over the years evident from the chart below. Therefore, we believe it’s important to gain access to China via a more diversified exposure to all share classes.

Figure 2 – Variation in returns in Chinese share classes across the years

Source: Bloomberg, WisdomTree as of 31 December 2021. Historical performance is not an indication of future performance and any investments may go down in value.

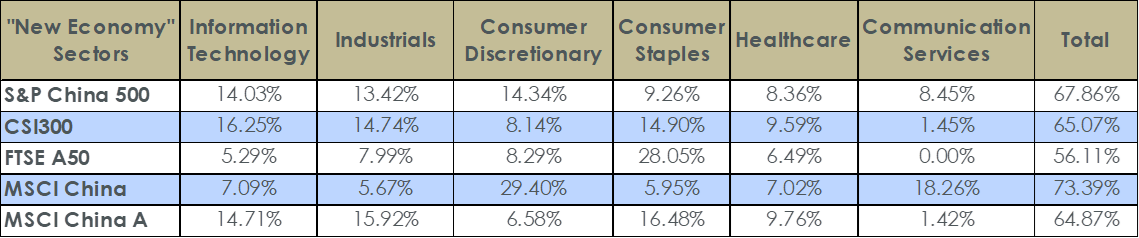

As of 31 Dec 2021, the MSCI China Index trades at 38% discount to the MSCI World based on forward Price to Earnings (P/E) ratio. Evidently Chinese equities boast attractive valuations versus the rest of the world and as monetary conditions become more conducive and regulatory hurdles subside, we expect Chinese equities to play catch up with the rest of the world. The sectors that have been weighed down last year – consumer discretionary (as it contains the largest e-commerce platforms and tutorial companies), communication services (as it contains some of the largest internet media companies), information technology (owing to smartphone producer disappointing due to the global chip shortage) offer the most upside opportunity in 2022. The S&P 500 China Index offers a more balanced exposure to sectors critical to China’s long-term transformation such as information technology (14.9%); Industrials (13.4%); Consumer Discretionary (14.3%); Consumer Staples (9.3%); Healthcare (8.4%) and Communication Services (8.5%) versus its peers.

Figure 3 – Balanced exposure to sectors benefiting from the transformation to “New China”

Source: Bloomberg, WisdomTree as of 31 December 2021. Historical performance is not an indication of future performance and any investments may go down in value.

The S&P China 500 Index has outperformed its peers since 31 December 2008 offering a 10% annualised return with a 21.38% standard deviation.

Figure 3 – Historical performance of the S&P China 500 Index versus its peers

Source: Bloomberg, WisdomTree as of 31 December 2021. Historical performance is not an indication of future performance and any investments may go down in value.

Conclusion

We expect 2022 – the Year of the Tiger to be another reversal of fortunes for China, quite like 2021 was a reversal of 2020. What makes us confident of the turnaround is – renewed policy easing efforts in China, lower inflationary pressure in Asia, gradual easing of regulatory headwinds over the course of the year. The biggest risk to our outlook rests on the emergence of COVID-19 variants which are difficult to predict.

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Retrouvez l’ensemble de nos articles Business