China’s most Recent Crypto Ban

Par Jason Guthrie, Head of Digital Assets, Europe, WisdomTree

On 24 September 2021, the People’s Bank of China (PBoC) reiterated its position that digital assets such as bitcoin, ether and tether do not have legal tender status. The PBoC made it clear that they prohibit activities such as marketing, payment/settlement and technical support when related to cryptoassets. It is also stepping up enforcement on crypto exchanges or persons acting as a central counterparty to any buying/selling activities and product issuance for Chinese clients.

Although relatively big news, this turn of events was not completely unexpected.

The message has been consistent from Chinese regulators on crypto assets for some time

Previously, on the 27 August 2021, the PBoC made an announcement in a press release[1] about its plan to prohibit financial institutions from developing and participating in crypto-related businesses. In a sense, the plan was already public and the market was just awaiting a timeline for implementation.

Timing of this crypto ban announcement coincides with the central bank’s own digital currency push

The PBoC has recently launched its central bank digital currency (CBDC), which has been rolled out to 28 regions including a major push in leading economic areas. Within a short timeframe, China has made its standalone digital yuan mobile app available to almost 10% of the population[2].

If the PBoC is pushing for CBDC rollout, why does it also have to ban crypto all together?

The short answer is to eliminate competition.

If we look at the 28 key target areas where China is looking to pilot the CBDC[3], pictured in Figure 1, the green dot is where Huawei and Tencent are based and the red dot is where Alibaba is based. These regions are the frontier of China’s high-tech development and often home to the most tech-savvy early adoptions. In addition, Sichuan, XinJiang, Yunnan and Inner Mongolia used to be the driving force in bitcoin mining in China.

These are the areas of China that were early adopters of mobile payments which are a driving force behind fintech uptake. If the PBoC want their digital yuan to take hold this will likely be a key battle ground for them to win hearts and minds. Speculation here is that they are looking to eliminate competition although the efficacy of such a move is yet to be determined, given people don’t flock to crypto simply because it’s “digital”.

Figure 1: China Pilot the CBDC Adoption

Source: spp.gov.cn; zeemaps

Bitcoin and the Central Bank Digital Currency are trying to do different things

There is potentially another reason that the PBoC is trying to block crypto. The core tenets of bitcoin are decentralisation and anonymous transactions, whereas the main aim of CBDC is centralisation and data collection. The CBDC is likely viewed as a good tool for the monitoring of economic activities, enhancement of the tax system and a way to (re)assert capital controls. This CBDC system suits the economic ecosystem in China. Banning other crypto assets, which exist in a competing ecosystem, would make sense if the end goal is to enhance their influence on the monetary system.

What this means for the crypto market

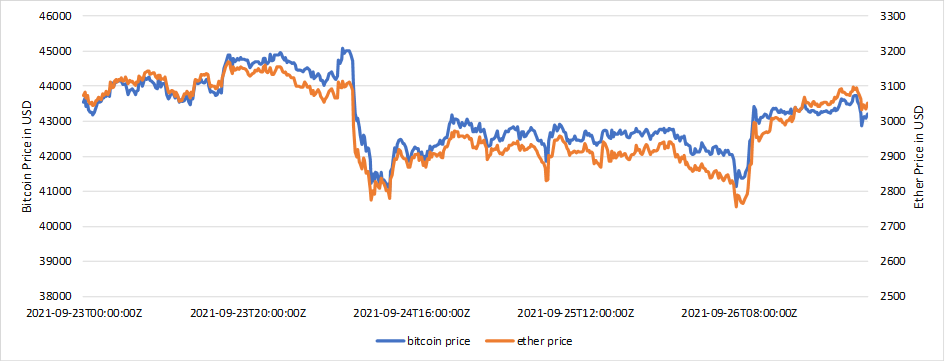

In light of the news of 24 September 2021, major crypto assets experienced a pullback with bitcoin (BTC) and ether (ETH) dropping around 10%, and the general market down from $2tln to $1.8tln within 4 hours[4]. However, prices quickly stabilised around $43k for BTC and $2.9k for ETH, then began rising again.

Figure 2: Bitcoin and Ether Price Movement

Source: Glassnode; Wisdomtree. Historical performance is not an indication of future performance and any investments may go down in value.

For crypto, with virtually no participation in mining and trading from Chinese accounts, there will be a short-term drop in demand which may affect volatility, although this seems to have been priced in relatively quickly.

Medium term impacts on demand are yet to be seen. The internet native nature of crypto means it is notoriously difficult for any authority to censor, even if that authority is China, so determined investors will likely find a way to re-enter the market. However, if the PBoC is effectively able to sell its digital yuan as a superior option, this could drive a localised slowing down and reduction in adoption rates.

The longer-term trend of reduced crypto concentration in China continues to be positive for the overall market. The US is typically the beneficiary as banned or restricted activities move offshore. This brings increased transparency and accountability, something regulators and investors have been calling for from both exchanges as well as miners.

Mainland Chinese participation in the crypto asset industry was already receding following the implementation of bitcoin mining restrictions in June 2021[5]. Affected miners have already moved their activities abroad, mainly to the United States, therefore, there is only limited potential impact of this announcement on any network fundamentals (e.g. Bitcoin hashrate).

Is this a proof point for Crypto?

As a final thought, we should recognise that the Chinese populace has been a great adaptor of crypto thus far. One of the potential use cases of native crypto currencies, such as bitcoin, is that it offers people a way to hold wealth, unencumbered by authorities, and a way to exercise greater control over their financial lives. A nation with high surveillance, a propensity for government interventions and capital controls should be fertile ground for such a value proposition. If the Chinese government is seeing adoption levels to a point where they feel the need to intervene, one could suggest that it has reached a level that is beginning to challenge their level of control and, in turn, proving the validity of this use case.

In other words, China may be banning Bitcoin simply because it works.

[1] https://www.cnbc.com/2021/06/21/bitcoin-btc-price-drops-on-china-crypto-mining-crackdown.html

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

[1] http://www.pbc.gov.cn/goutongjiaoliu/113456/113469/4326288/index.html

[2] https://www.theblockcrypto.com/news+/117641/china-digital-yuan-smart-contract-programmable

[3] http://www.gov.cn/zhengce/zhengceku/2020-08/14/content_5534759.htm

[4] https://coinmarketcap.com/charts/

[5] https://www.cnbc.com/2021/06/21/bitcoin-btc-price-drops-on-china-crypto-mining-crackdown.html

Retrouvez l’ensemble de nos articles Business ici